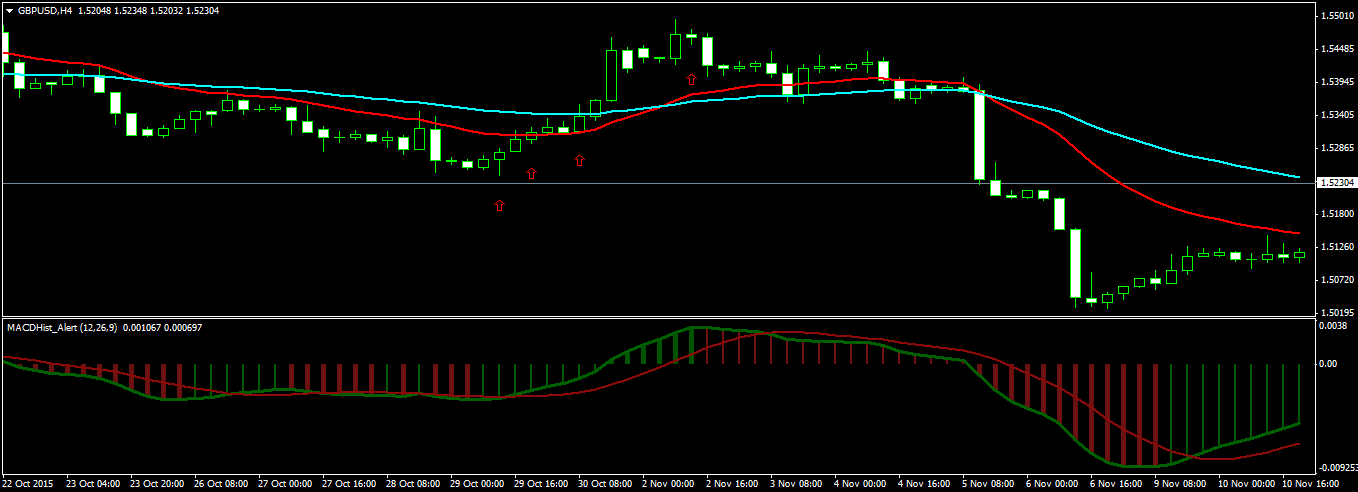

GBPUSD is a great pair that moves lot. We love to trade this pair; it’s just that you need a lot of guts to trade this pair as it can change direction all of sudden hitting your stop losses. The key to trading this pair successfully is taking risk management very seriously and not risking more than 2% of the account equity at any point of time. Take a look at the following screenshot.

As you can see in the above screenshot, GBPUSD indeed moves a lot. I have highlighted 3 swings in the above chart. First is the swing high that was around 200 pips. Then came a big swing down that was almost 400 pips and then again another swing high that was around 250 pips. So the total movement that GBPUSD made in these 14 days was around 850 pips. You can see very big white H4 candles made by GBPUSD in the down swing. These type of candles are formed as a result of news release. We discuss these candles in this post in detail as well. So let’s start with the swing high. Look at the chart below.

The red arrows shows the positions that we opened for this buy trade. We love to trade naked. Naked trading means depending solely on price action. You can see the big bullish candle just above the first red arrow. This was the first entry at 1.52813 and the stop loss is 1.52400. So the risk is 41 pips. Suppose we had $1000 in our account. We can use a 0.1 lot which will mean a risk of 4.1%. It depends on your risk appetite. We made the decision to take this risk. If you are not comfortable with 4% risk you can reduce your lot size to 0.05 which will give you a risk of 2%. But hey, trading is all about risk taking. As long as you don’t risk more than 5%, you run little risk of taking a heavy loss.

We open second position just above the second red arrow. Our entry is 1.53136 and move the stop loss to breakeven at 1.52813. So the first position is risk free while the risk for the second position is 32 pips. We open the trade with 0.1 lot so our total risk has now reduced to 3.1%. Just above the third red arrow we open the third position at 1.53386 and move the stop loss to 1.53136. So the first 2 positions are now risk free. The third position has a risk of 25 pips while the first two positions are in a profit of 32 pips. So even if the stop loss gets hit we still end up with a profit of 7 pips. From now on our buy trade is totally risk free.

You can see a very beautiful inside bar just above the fourth red arrow. Inside bar is a strong trend reversal signal. So we close all the 3 long positions at 1.54674 and open a short position at this price with stop loss at 1.55000. The profit from the long trade is 186 pips + 154 + 129= 469 pips or $496. So we make almost 50% return in 2 days of trading. We have now $1496 in our account as equity. We opened the short position with 0.1 lot. Our risk is 33 pips or 3.3 %. Now take a look at the following screenshot.

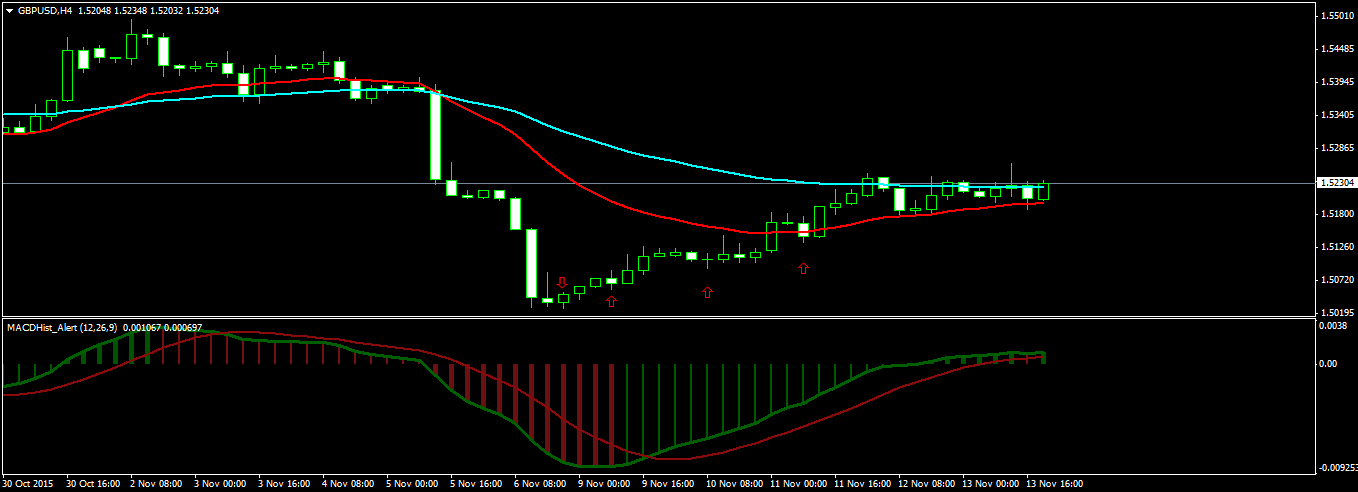

In the above screenshot you can see a very beautiful downtrend. As said above we opened out first position at the formation of the inside bar when we closed the long trade and opened a short trade. The second entry was just below the second arrow at 1.54086 and we moved the stop loss to 1.54500. First position is in a profit of 17 pips while the risk for the second position is 42 pips. So our total risk is 25 pips or just 25 pips. Since we are trading with 0.1 lot, the risk is 2.5%.

Price makes a rebound and the stop loss just gets hit but we survive by 4 pips. So if the stop loss had been hit we would have been out of the trade with a loss of $25 which would have been nicely covered by the profit from the first long trade. But we are lucky and the stop loss survives. This is the nature of trading. Price can rebound anytime. There can be many reasons for that. Since we are swing trading, primary reason is the release of a good economic report. But then price did not touch the stop loss. It started falling and just before the MPC Rate Votes we find a good bearish signal just below the third red arrow. We open the third position at 1.53806 and the stop loss 1.5405. The first 2 positions are now in a profit of 65 pips while the third position has a risk of 25 pips. So even if the stop loss gets hit we end with a net profit of 40 pips.

MPC Rate Votes sends GBPUSD in a nosedive 200 pips and we have a very big white bullish candle. Next day is the NFP Report release which is again bullish for USD and send GBPUSD down another 200 pops. We close all the trades at the formation of a bullish candle shown below the first red arrow in the screenshot below.

We close all the short positions at 1.50503 and open a long position. So we make a total of 417 + 350 + 330 = 1,097 pips. Since our lot size was 0.1 we end up with a profit of $1,097 and this short trade made a return of 100%. So our total return is 150% and our account equity is now $2,593.

We close the short position and open the long position at 1.50503 and the stop loss is at 1.50250. So the risk is only 25 pips. Since we have now $2,593 in our account we open the long position with 0.2 lot and our risk is 2%. We open another long position just above the second red arrow at 1.50683 and move the stop loss to breakeven for the first position at 1.50503. We open the third long position just above the third red arrow at 1.51068 and move the stop loss to 1.50880. We open the fourth long position just above the fourth red arrow at 1.51443 and move the stop loss to 1.51300. We close all the long positions at 1.52392.

So the total profit from this long trade is 189 + 171 + 133 + 95 = 588 pips. Since we had opened the trades with 0.2 lots, the total profit is $1,176 and the return from this long trade is 45%. So we end up with $3,769 inn 14 days or a return of 376%.