USDCHF surprised many traders in January. USDCHF went down around 1,800 pips in just under 1 minute when the Swiss National Bank (SNB) unpegged Swiss Franc from EURO. Many big brokers got bankrupt on that decision. Many traders found their accounts blown up. However, this time the surprise was not that big. It was only 200 pips.

The franc weakened against all 16 of its major peers after the decision, which makes holding the currency in those accounts more unattractive. The Swiss National Bank announced the measures, which follow criticism that public institutions were being shielded from the charge, in a statement Wednesday. UBS Group AG described the move as a “very marginal” step.

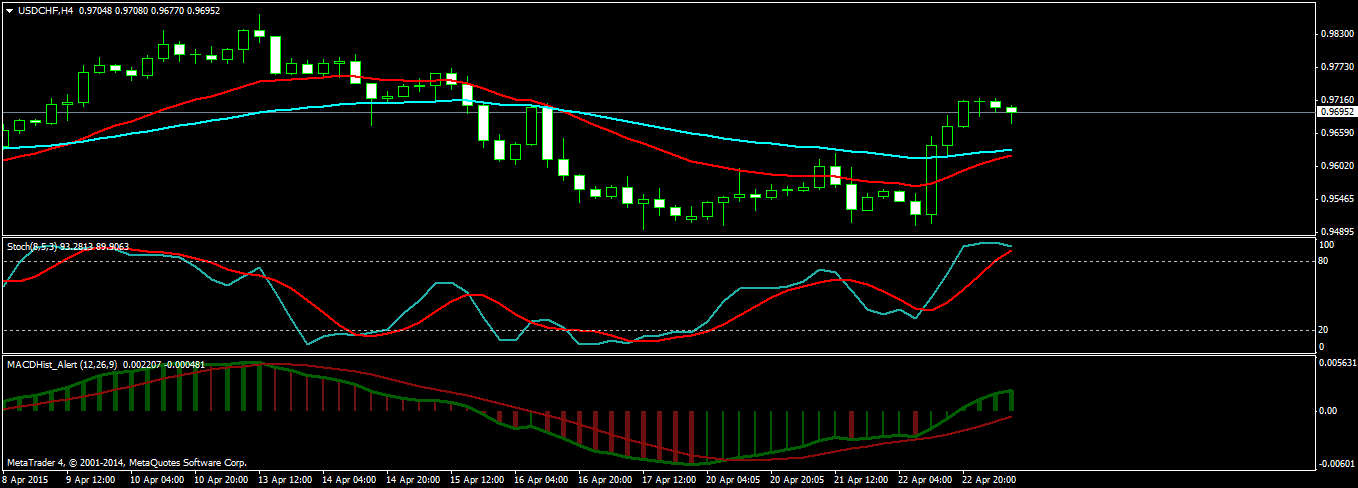

Everything was there on the charts to see. Take a look at the USDCHF H4 chart below.

As you can see in the above chart, there is a clear bullish divergence been show by the Stochastic before the announcement so the market has been anticipating this thing and it was reflected into the chart. As a technical trader, you should know that charts just reflect what the market is thinking. So always believe what the charts say.