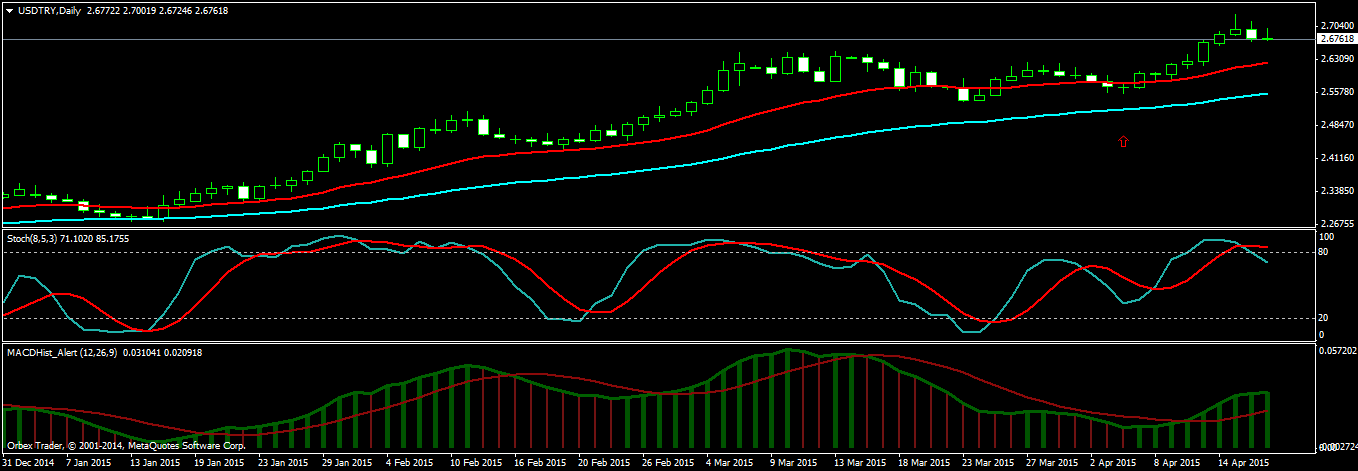

USD/TRY is an exotic pair. TRY is the symbol for the Turkish Lira. USD/TRY is a pair that has a lot of potential for us currency traders. It moves a lot and if we can catch that movement, we can make a lot of pips. The idea is the catch big moves with small risk. Below is the analysis of a trade that I could have made. I didn’t make this trade. But I am planning to regularly trade USD/TRY. My broker offers USD/TRY for trading with a spread of 20 pips. Check if your broker has this pair for trading and what is the spread. Similarly it will be a good idea to trade USD/MXN and USD/RUB. MXN is the symbol for the Mexican Peso and RUB is the symbol for Russian Rubble. More on these 2 pairs USD/MXN and USD/RUB later. By the way my broker does not have USD/RUB and USD/MXN pairs for trading. Since I want to trade these 2 pairs also, I will need to look for a broker that provides these 2 pairs for trading also. For now, let’s discuss how much lucrative USD/TRY can be. Take a look at the following daily chart.

What do you see in this daily chart?? USD/TRY is in a strong uptrend. EMA55 (Aqua) is well below EMA21 (Red) which means a strong downtrend. So we wait for the price to retrace towards EMA21 (Red) which it does just above the red up arrow. This is the time to make an entry. We use the H4 chart now to make the entry. Take a look at this USD/TRY H4 chart below!

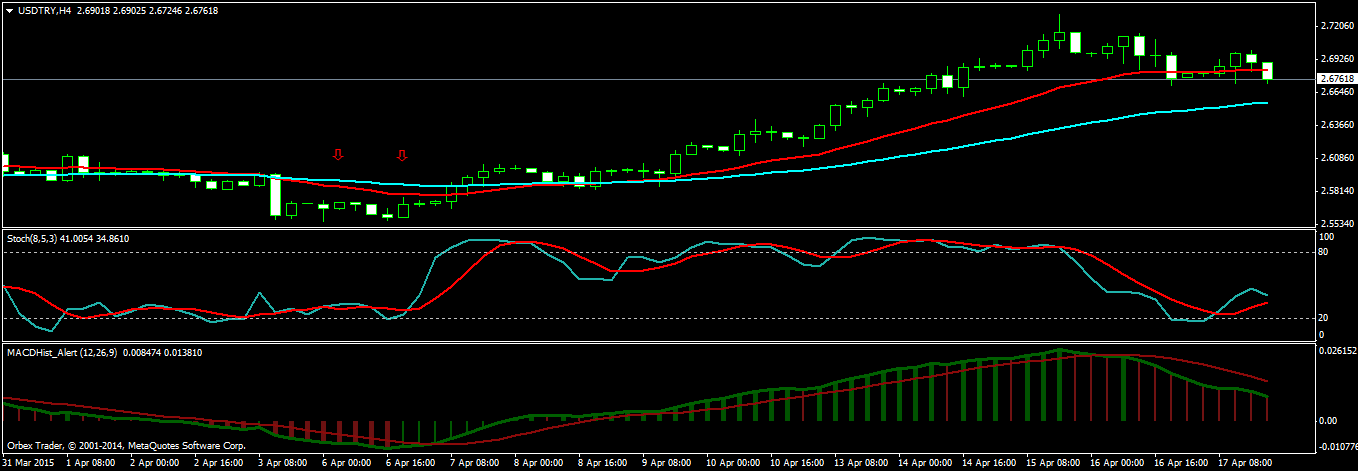

Red arrows pointing down is the place where we would have made an entry. Our entry would be 2.55900 and the stop loss would be 2.55541+ 20 pips (spread). So the risk of the trade would be 64 pips. The next entry would be 2.57112 and we would have moved the stop loss to 2.55900 making the first position breakeven. Our third position should have been at 2.59660 and we would have moved the stop loss to 2.58560 making the first 2 positions breakeven.

Now just let the trend continue. We would have closed the trade around 2.70000. This would have made us 1,400 pips on the first position and 1,300 pips on the second position and around 1100 pips on the third position giving us a total of 3,800 pips in just 7 days.

So you can see how much lucrative these exotic pairs can be. Remember what happened to Rubble last year when it took a deep plunge then recovered a little bit then again took a plunge. Rubble fall was as much as 50-60% in a few weeks. If we could have capitalized on that fall, we could have made many pips. Similarly Mexican Peso had a big fall last year. Mexico’s currency fell to a six-month low after Moody’s Investors Service said it may cut the credit rating for state-run oil monopoly Petroleos Mexicanos, signaling the government’s borrowing costs may rise.

You really don’t need to know what the fundamental news is. You just need to look at the charts and trade what the technicals are saying. Just like what the technicals were saying about USD/TRY that it is in a strong uptrend. We just waited for the retracement and then made an entry and just made sure to manage our risk properly. When you trade trends and open new positions, it is essential that you make the first position breakeven before you open the new position. This way you are not adding any additional risk to your positions. Risk management is the key here and if you can learn how to manage the risk in a trade well, you are on your way to become a millionaire forex trader.